Considering Alternative Financing for Your Business? A Few Things You Need to Know

The financing needs of SMEs have evolved as business models increasingly shift towards knowledge and technology activities. While the banking sector continues to be the predominant financing provider, there has also been a gradual expansion in alternative financing, including leasing, invoice factoring, equity crowdfunding and P2P financing. In this light, there is room for alternative finance to complement traditional bank financing in meeting the new needs of businesses.

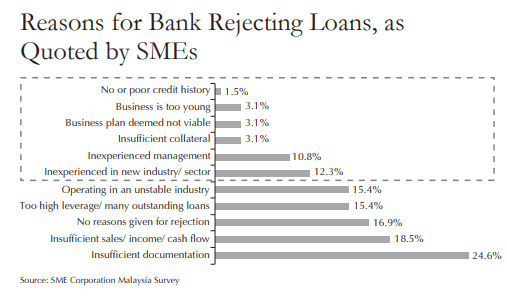

SMEs in Malaysia have increasingly adopted IoT in their operations. This adoption has shaped SMEs to be more opportunity-driven and deploy innovation to capitalize on new trends. This adoption has led to the booming of sharing economy & e-marketplaces. The term for these SMEs is sometimes called startups. These startups face challenges in accessing bank financing due to several reasons:-

-

The credit evaluation process of banks heavily relies on collecting and analyzing the massive amount of historical and qualitative data of the borrower. These startups might not have sufficient historical track records for the banks to evaluate them, which leads to rejection of the financing.

-

Banks sometimes requires the borrower to provide some form of collateral to mitigate the risk of non-performing loan or default.

-

Last but not least, banks also sometimes rely on relationship data to supplement the credit evaluation, such as borrower's character, trust references, and integrity. This data can't be built overnight and requires the borrower to have a long-standing relationship with the bank.

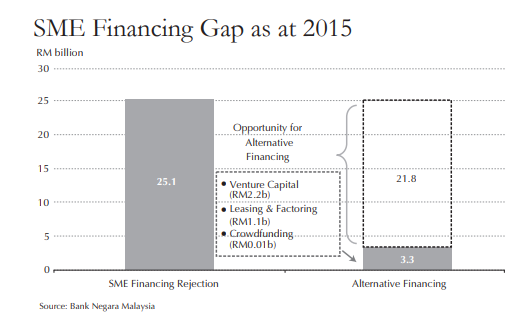

The Securities Commission (SC) Malaysia acknowledges a financing gap between the banks and the SMEs in Malaysia. In 2016, SC then introduced the framework of equity crowdfunding (ECF) and Peer-to-Peer (P2P) financing to bridge the financing gap and meet the investment need of the emerging digital generation. SC Malaysia regulates the ECF and P2P operators in Malaysia under the Capital Market Services Act. As of date, 11 P2P operators in Malaysia offer alternative financing to SMEs.

Peer-to-Peer (P2P) Financing for SMEs in Malaysia

There are 11 licensed P2P operators in Malaysia today. These P2P operators are licensed by SC and regulated under CMSA to provide SMEs with alternative financing and asset classes for investors. These P2P operators leverage digital platforms to offer alternative funding to SMEs in Malaysia. The alternative financing space accounts for about 3% to 5% of the total financing landscape in Malaysia.

Each P2P operator offers alternative financing to the SMEs, such as invoice financing, asset financing, and micro-financing to MSMEs. The most common of all is business financing or working capital financing, which works similarly to the bank term loan. P2P provides an alternative option for the startup scene in Malaysia to fuel their business growth while waiting to build a historical track record to get funding from the banks.

There is also a P2P operator that provides insurance premium financing for business insurance to protect their business or assets like Cofundr. Insurance premium financing is a unique product offered by Cofundr as it gives the opportunity to business owners to protect their business with insurance without further burdening their costs. Cofundr's Insurance Premium Financing is the answer for most SMEs owners in Malaysia, especially during the recent floods in December 2021, where SMEs suffered about RM600 million worth of damages to their business due to not protecting their business and assets with insurance. To know more about Cofundr's Insurance Premium Financing, go to (https://kitacover.com/), a CSR initiative that offers zero financing costs for SMEs who did not buy insurance for their business. Find out more about Cofundr at (https://www.cofundr.com.my/).

Many SMEs or startups now look at P2P alternative financing as the solution to their early-stage funding or short term business funding needs because:-

-

Faster processing time for SMEs or startups to get funding from P2P than the banks, where it usually takes three months. SMEs can apply for financing thru the P2P operator's platform.

-

Less stringent credit evaluation compared to the banks.

-

SMEs or startups can obtain funding as long as they are in operations for at least six months.

-

Curated terms based on the SME's needs as P2P operator offers different product matrices such as invoice financing, micro-financing, invoice financing, and insurance premium financing.

Even with less stringent credit assessment and faster processing time, P2P operators do not discount carrying on proper due diligence and qualitative evaluation on SMEs when looking for financing to protect investors' interest and risk exposure. P2P operators must find a balance between the demand (SMEs looking for funding) and the supply (investors in crowdfunding); hence, keeping a low default rate is always the best practice to ensure this equilibrium is met.